Dear Hustlers, in this priceless article today we will show you how you can generate Track 1 with Track 2 for your dumps, so if you have already bought your 101 or 201 data dump elsewhere that just came with Track 2, now we will show you how you will be able to generate Track 1.

UNDERSTANDING TRACKS

#TRACK 1

The first track contains the credit card number, the credit cardholder’s name, and the credit card’s expiration date.

Track 1 is the only track of the card that contains the account holder’s name, but you can change the name from the track to match with the fake IDs you have or with the name embossed on the plastic, and that will still work 10 out of 10 times.

This track is written with code known as odd parity, or “Dec Sixbit.”.

Track 1 format is usually as follows:

- %B3703730081187237^BRAND/STARK D ^200910100000023001000000415000000?

- START SENTINEL = is 1 character, usual ( % )

- FORMAT CODE = a single character; financial cards format code is (B )

- PRIMARY ACCOUNT NUMBER (PAN) = usual is the card number, but not always ( 3703730081187237)

- FIELD SEPARATOR = financial cards use a single symbol for it which is ( ^ )

- NAME OF CARDHOLDER = contain 2 until 26 characters (BRAND/start)

- FIELD SEPARATOR = symbol for it is ( ^ )

- EXPIRE DATE = in format YYMM (2009)

- SERVICE CODE = three characters (101)

- DISCRETIONARY DATA = which may contain PIN VERIFICATION KEY (it is not the ATM PIN), card verification value, CVV (00000023001000000415000000)

- END SENTINEL = is 1 character, usual ( ? )

#TRACK 2

The second track, which includes the credit card number and the expiration date, is crucial and can determine whether your ATM will accept your payment or reject it.

Almost all dumps will spit out cash if track 2 is correct. It is written with a 5-bit scheme, 4 data bits, and 1 parity bit. A parity bit, or check bit, is a bit added onto track 2 for error detection as it requires the authorisation step to be discarded entirely or re-transmitted from scratch, which is what makes the ATM spit out your card in case of a problem with your track 2.

This track data format is as follows:

- 370373660206009=200910118023328700000?

- START SENTINEL = is 1 character, usual ( ; )

- PRIMARY ACCOUNT NUMBER (PAN) = usual the card number ( 370373660206009 )

- SEPARATOR = usual symbol ( = )

- EXPIRE DATE = in YYMM format (2009 )

- SERVICE CODE = a three-digit code ( 101 )

- DISCRETIONARY DATA = which may contain PIN VERIFICATION KEY (it is not the ATM PIN), card verification value, CVV (18023328700000 )

- END SENTINEL = usual the symbol ( ? )

#TRACK 3

The third track contains information about customer loyalty programs; some banks use it for programs such as airline rewards, but it is virtually unused by the vast majority of banks. It was developed by the thrift-saving industry. Point of Sales (POS) will not read this track.

SERVICE CODES

The card service code is a 3-digit code present in both Track 1 and Track 2.

Each of the 3 digits of the code has a meaning and read it together The service code let you know where and how the card can be used

#IF THE FIRST DIGIT IS:

- 1 – the card is for international use

- 2 – the card is for international use but has a chip

- 5 – the card is for national use

- 6 – the card is for national use but has a chip

- 7 – the card is not good for interchange except for bilateral agreements

- 9 – test card

#IF THE SECOND DIGIT IS:

- 0 – the card is normal, without restriction

- 2 – issuer must be contacted via online means

- 4 – issuer must be contacted via online means except under bilateral agreements

#IF THE LAST DIGIT IS:

- 0 – no restriction but the PIN is required

- 1 – no restrictions

- 2 – the card can be used for goods and services payment but not for cash

- 3 – ATM use only; PIN is required

- 4 – cash only

- 5 – the card can be used for goods and services payment but not for cash but PIN is required

- 6: No restrictions; PIN should be used where feasible

- 7 – the card can be used for goods and services payment but not for cash but PIN should be used where is feasible

Now you have a fairly solid understanding, although you may not think that you do but feel free to go over this priceless information a few times to observe and let it sink in.

Once you understand the basic principles of what these tracks are, how they work, and what service codes are used for, you can continue expanding your knowledge with us. We are on a mission to provide you with all the knowledge and tools thereafter to put all the theory you learnt and understand into practice by doing it.

GENERATE TRACK 1 USING TRACK 2

If you have just scrolled down to this section by skipping all the information above, you will be missing a critical piece of information. Those who have read the entire article above before coming to this section would know exactly what we mean by that.

So in order to generate Track 1, let’s take the example of this dump Track 2 (this is an actual dump):

- 4867327031853618=15051011203191805191 – this is Track 2 (we want to make Track 1 out of Track 2).

- JOHNSON/CHARLOTTE is the name of the cardholder (LASTNAME/FIRSTNAME)

- JP MORGAN CHASE BANK is the bank’s name

- The United States is the Country of Bank

- DEBIT – this is the type of card, whether its a credit or a debit card (in this case, a debit card)

- Classic is the brand of card, e.g., Traditional, Classic, Gold, Platinum, Business

So when you see an equal sign “=” in a track, it always means it is Track 2 and when you see the letter “B” in front of the track, it is always Track 1.

#STEPS:

Now to Make a Track 1 From Track 2, this is how we do it, and you can copy our technique to generate your track 1:

So as mentioned above we have Track 2, 4867327031853618=15051011203191805191 but let’s just take the credit card account number from this Track 2 so the card number is 4867327031853618.

Add the letter “B” in the front of the number like this:

- B4867327031853618

Then add the cardholder name you want to show on the card using “^” at the start and the end of the name, just like this:

- B4867327031853618^Johnson/Charlotte^ (Last-Name/First-Name)

Next, you will add the expiry date and service code (the expiry date is “YYMM” in this case, “1505”, and in this case, the 3-digit service code is “101,” so you will be adding “1505101”). So now what we have is:

- B4867327031853618^Johnson/Charlotte^1505101

Now add 10 zero’s after the service code like this:

- B4867327031853618^Johnson/Charlotte^15051010000000000

Next, you will add the remaining numbers from Track2 (after the service code) like this:

- B4867327031853618^Johnson/Charlotte^150510100000000001203191805191

And finally, you will add six zero’s (6) zero’s after that, like this:

- B4867327031853618^Johnson/Charlotte^150510100000000001203191805191000000

So the final track would look like this:

Track 1: B4867327031853618^Johnson/Charlotte^150510100000000001203191805191000000

Important Note: This Track 1 generation process is valid for “Visa” and “MasterCard” only; it will not work for Discover, Amex, and so on.

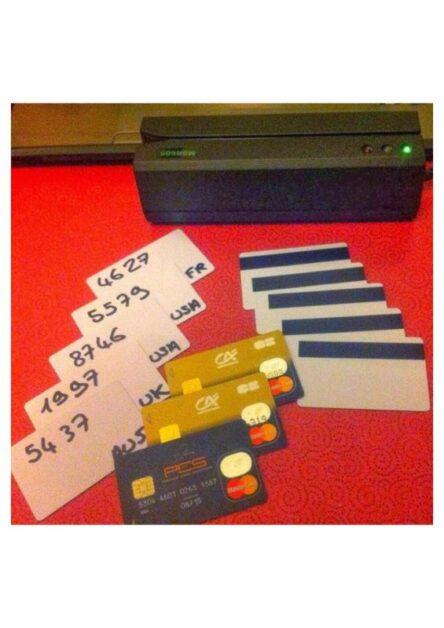

Also, a very important thing to take into consideration is that you do not need to generate track 1 should you decide to buy your 101 or 201 data dumps on our site, as our dumps are complete and come with:

- Track 1

- Track 2

- PIN

Congratulations! Today you have learnt another priceless piece of information that you did not know otherwise. On our site, we always try our best to come up with the latest information at your disposal.

Good luck! Get your success; you deserve it. We will see you on the other side!